Mastering Payroll Success with Zoho Payroll: Your Gateway to Effortless Compliance and Accuracy

Expert Blog #07

Expert Blog #07

Payroll is one of the most critical and sensitive functions in any organization. From salary calculations to statutory compliance, even a small mistake can lead to unhappy employees or legal issues.

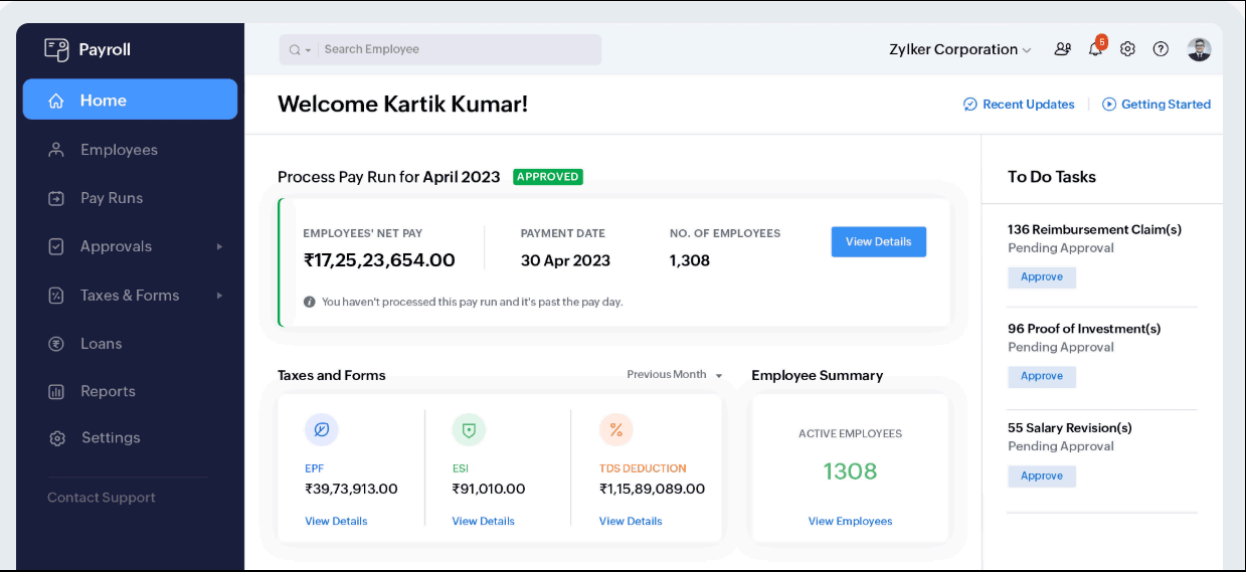

Zoho Payroll is a cloud-based payroll solution designed specifically for Indian businesses to simplify salary processing, tax compliance, and employee payments — all in one platform.

In this blog, we’ll explain what Zoho Payroll is, how it works, its key features, and why it’s a good choice for growing businesses.

Zoho Payroll is an online payroll management system that helps companies:

It integrates seamlessly with other Zoho products such as Zoho People, Zoho Books, and Zoho Expense, making it a complete HR and finance ecosystem.

Zoho Payroll calculates salaries based on attendance, leave, bonuses, and deductions — reducing manual effort and errors.

Zoho Payroll supports Indian statutory compliance including:

It also generates statutory reports required for filing.

Payslips are generated in a standard format, and employees can access them through their self-service portal.

Attendance, leave, and employee data can be synced directly from Zoho People to Zoho Payroll.

All payroll data is securely stored in the cloud with role-based access control.

Zoho Payroll is not just a payroll tool — it’s a complete payroll and compliance platform designed for Indian businesses.

If your organization is looking for a reliable, easy-to-use, and compliant payroll solution, Zoho Payroll is a smart choice.

Ready to Transform Your Business?

Contact us today to learn more about how ZYENAC Solutions can help you leverage Zoho Payroll for success.